By Mike Koetting

Republicans in Congress declared the week of July 14 as “Crypto Week” with the intent of passing three bills on crypto currencies as part of a push to boost and legitimize the U.S. cryptocurrency industry by giving it a regulatory framework that’s lighter than what traditional financial assets and institutions face but at the same time creates an aurora of legitimacy. All three of these bills passed. One, the so-called GENIUS Act, had already been passed by the Senate—with 18 Democratic votes– and Trump has signed it into law. The other two also passed, but face an uncertain future in the Senate. Not surprisingly, the value of existing cryptocurrency soared with the attention. Bitcoin, the best known cryptocurrency, hit an all-time high.

The details of these bills aren’t anywhere near as important as the fact that crypto is being treated seriously. There is no compelling reason for cryptocurrencies and profound reasons why they should simply be ignored. Or banned if ignoring them turns out to leave too many risky possibilities in play.

Why Do We Need Crypto?

The fundamental problem I see with crypto is not technological, although the technology is a technological tour de force. The question is what does society get out of cryptocurrencies?

As far as I can see, nothing of import.

Crypto currently has two primary uses: a medium of exchange for people who want to hide their identify—malware ransom, payment for crimes and drugs, bribes, and so forth—and a as new venue for speculation. Unlike conventional stocks, which undergird real economic activity (e.g. GM, Amazon, Johnson & Johnson) and whose value is roughly tied to the performance of the underlying activity, cryptocurrencies have no referent in the real world economy. Investing in cryptocurrencies is not unlike investing in tulips in 17th century Holland. Some people will win, and some people will lose, but it has no inherent connection to any economic activity. It is purely a medium of speculation.

Crypto is also used to simplify some banking transactions, but as a share of total use, these applications are microscopic.

The GENIUS (Guiding and Establishing National Innovation for U.S. Stablecoins) Act creates a light-touch regulatory framework for cryptocurrencies provided they are backed by some recognized form of currency (e.g. US Dollars). While experts say this offers some basic security for investors which is currently lacking, it also opens the door to expanding other problems. Moreover, it does not address the more fundamental question as to what crypto is offering society that it can’t get elsewhere.

Could there be more uses for crypto? It is true that their decentralized nature theoretically removes the necessity for traditional banking. I suppose one could imagine a certain set of catastrophes that render the world’s banking system unable to function. But not only is that unlikely, it is not clear that the ability to use cryptocurrencies would remain in those extreme circumstances. Also, banks exist in a current regulatory environment which provides a broad range of protections to society. The GENIUS Act begins to recreate such an environment for crypto but crypto’s very nature, by design, makes it harder to accomplish that. Nor is it obvious what are the residual benefits of crypto that make creation of a separate regulatory framework a good investment at a time when we are cutting resources for FEMA, Social Security and science.

Another argument I have heard is that crypto is so energy intensive that it will force the world to get more serious about alternative energy sources. Suggesting the best way to achieve growth of alternative energy sources is to create an unnecessary currency speculation machine—as opposed to raising more people out of poverty or, even saving the world from burning itself up—suggests a serious derangement of social priorities.

Energy

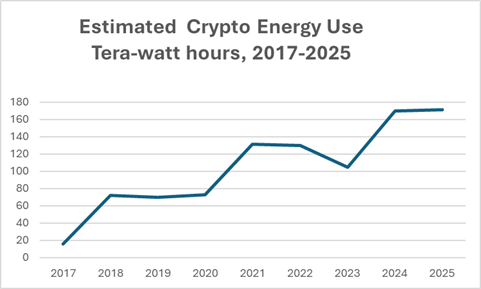

The fact that crypto is without purpose is, by itself, not a reason to be concerned. But the fact that it is such prodigious user of electricity is. As much as we correctly promote electricity as a cleaner form of energy, by no means is all of its creation green, even in the US. Moreover, under no existing circumstances is it free nor unlimited. Right now, there are many projects in the US on hold because of lack of grid capacity.

Current world-wide energy devoted to mining cryptocurrencies—“mining” is the technical term for the process by which crypto is validated—is roughly equal to the entire energy consumption of Poland. Initially, most of the crypto mining was in China. But in 2021, citing concerns about fraud, economic instability, and meeting its climate goals, China’s government pulled the plug on decentralized digital currencies. Now the US is the world’s largest crypto mining source, accounting for more than one-third of all such activity. In 2022, the world’s largest facility was in Rockdale, Texas and was reliant on fossil fuel for 96% of its output. The amount of energy consumed there annually is equivalent to the average energy consumption of one million citizens of India.

Source: Digiconomist

How Did We Get Here?

A reasonable person might will wonder if crypto is so lacking in real benefit and is remarkably energy consumptive, how do we come to have “Crypto Week” in Congress. As it turns out, the answer is atypically uncomplicated: money.

In 2024, super PACs associated with crypto collected more than $170 million. That was more than nearly any other super PAC. Pro-crypto donors are responsible for almost half of all corporate donations to PACs in the 2024 election cycle, and the tech industry has become one of the largest corporate donors in the nation. For example, Fairshake, a pro-crypto PAC, in the last week of the California Senate primary dumped $10 million into negative ads against Kate Porter, most them based on incorrect information. (By comparison, her entire campaign budget was $30 million.) She lost.

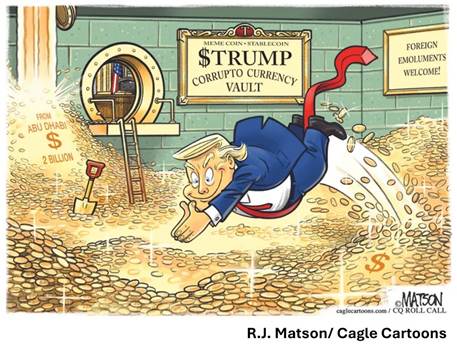

Donald Trump once called crypto “a sham”. But after a group of crypto investors met with him in Mar-a-Lago and offered to contribute $100 million to his campaign he had an epiphany. That night he posted on Truth Social the exact message the investors had given him, adding is own bizarre touches, such as suggesting crypto would make the US “ENERGY DOMINANT!!!”.

Perhaps what changed Trump’s mind was the thought he could make enormous sums on crypto. If so, he was certainly right. The Trump family’s crypto holdings, which include the $MELANIA meme coin, birthed just after $TRUMP, have topped $2.9 billion, according to an April report. Meanwhile, the United Arab Emirates-based fund has purchased $100 million worth of digital tokens from World Liberty Financial, which is majority-owned by the Trump family.

Other scams abound. The overall story of corruption is so shameless it is hard to accept it is going on in plain sight. That Congress is failing to enforce the emolument restrictions—which are spelled out in the Constitutions—is further evidence that they have given up enforcing the Constitution at all.

Nor is it all about the president. Crypto spent millions in fifty 2024 Congressional races. The results had the crypto industry boasting that it elected 235 pro-crypto candidates to the House and 16 Senators. One of the organizers of this massive campaign put it this way: “The most important message from this election is that crypto wins.” At the beginning of “Crypto Week” in the House, Fairshake—the main crypto PAC—announced that it already had $141 million ready to invest in the 2026 midterms, a not so subtle warning to those Representatives thinking about straying.

A peculiar footnote. One study suggests there is also strong support for crypto among young men who feel they have no good road to economic success, a group that Trump carried with a 54% margin. While I am not sure how much weight to place on a single study, this observation does fit in with a larger narrative that as society has made it harder for all but certain elites to get ahead, those left behind are indulging in other strategies, including the magical thinking of quick fortunes from crypto.

Here We Are

So, the recently purchased Congress had “Crypto Week”. Most voters didn’t know what happened and, even if they did, they wouldn’t care. It’s too technical and it doesn’t seem to affect them. But this is another choice our society is making without remembering that choosing for something almost always means choosing against something. I seriously doubt that there is anything like a majority of Americans who would support prioritizing crypto schemes over other potential energy uses. Or who would be willing to pay higher electric bills—a likely outcome—to support it.

But, I guess, if enough people put enough money behind it, “Crypto wins.”

Nailed it.

LikeLike