By Mike Koetting

January 16, 2018

In my first blog after the fall hiatus, I want to address the Tax Bill and some related issues. Then I’ll take a quick pass at health care before I return to-my series on what I think are the most fundamental issues facing society. Unsurprisingly, they didn’t resolve themselves while I was busy with other things.

****

Chicago Tribune

Chicago Tribune

I don’t intend to use this post to analyze how the Tax Bill passed by Republicans was so awful. There are plenty of analyses of that, and most of them better than I could do. What has fascinated me is why Republicans made the choices they did.

The obvious answer is that the Republican party is simply beholden to the rich and the rich can never have enough money. That, of course, is part of the answer. (There is a great line in the movie, All the Money in the World, when the character playing J.Paul Getty responds to the question as to how much money he would need to feel secure: “More.”) But I don’t think that is the whole answer. Or maybe not even the primary answer.

I think one needs to start with the official Republican position that these tax cuts will effect profound changes in the economy and, indeed, pay for themselves, positions I find so incredulous my first instinct is to write it off as a cynical lie to disguise self-aggrandizement. But the more I listened to them, the more I became convinced that most of them really believed this—despite the fact that only the tiniest sliver of professional economists, let alone history, suggested this was likely. So, how do they get there?

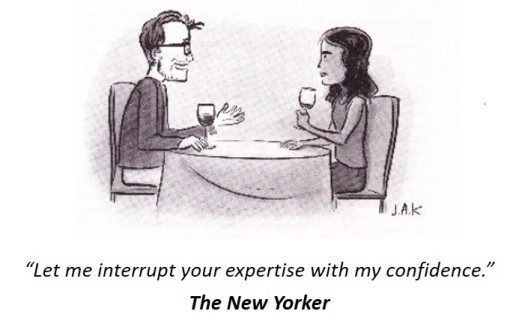

One element, and a particularly dangerous one, might be the utter distain Republicans have for “experts”. On the surface, it would seem there is no inherent conflict between developing great expertise on some subject and a political position. But, it turns out there is.

To understand this, one needs to think about the really core belief of Republicans and the nature of science (and near-science, which is where I would score economics).

I am increasingly of the mind that all political persuasions ultimately come down to the question of whether you believe the most fundamental obligation of a society is the welfare of the collective or the individual. I am not suggesting some starkly “either-or” proposition. Sane people understand that without some balance we sink into either Hobbes’ “war of all against all” or Orwell’s “Big Brother is watching.” But within that balance there ultimately needs to be a North Star—”as important as the rights of individuals are, the goodness of a society is measured by collective welfare” or “while it is foolish to ignore collective needs, it is even more important to protect individual freedom.” Republicans have always been the party of the individual over the collective.

I believe that in the Republican mind this follows from another bulwark of their creed: individuals succeed because they are more worthy. They are smarter, they work harder, they take greater risks, they have better genes, whatever. If you really believe this, then it’s a short hop to the idea that anything undercutting the ability of the [more worthy] individual to succeed is suboptimal for society, maybe even dangerous. And conversely, propping up the less worthy degrades the overall society.

Surely individualism opens many doors and too much collectivism dampens opportunity. One can see this in international comparisons. Even without going to the pathologies of totalitarian societies, it is clear that historically American society has thrived in ways more conformist cultures have not. There is a meaningful tension here and threats to individualism should not be dismissed carelessly.

On the other hand, there are also lines of causation that are in fact the flip side of the original question of individual versus collective welfare: individuals’ ability to be “worthy”—indeed the entire definition of what it means to be “worthy”—is shaped by the collective. Yes, some individuals seem to be better able to rise above circumstances than others, but outliers do not change the fact that the social systems created and supported by the collective significantly impact individual abilities and successes. They give some individuals a head-start or by place significant barriers in the way of other individuals. There is no “state of nature” here—an imaginary state where there are no social systems tilting the field one way or the other. There is no getting way from the fact that humans are essentially, even if not always definitively, shaped by their social conditions.

Which brings me back to why the Republicans hate experts and love the tax bill.

For the Republicans, experts have two fatal flaws:

First, Republicans hate experts because experts are “experts”. Experts claim to have knowledge superior to “common sense” and since Republicans believe so strongly in their own inherent worthiness, they can’t image that their common-sense explanation of events are not sufficient. (Consider Rep. Mo Brooks’ (R, AL) suggestion that people who live right don’t need health care.) Worse yet, in the Republican minds these “experts” aren’t people who really accomplish things (e.g. making money) but who have holed up in institutions without ever having to meet a payroll. And, in the process, turned young people into skeptics about the wisdom of their elders.

Second, Republicans are uncomfortable because the experts are tending to find more and more ways that the situations of human beings are less than in their own control than is consistent with a philosophy that puts overwhelming causality at the individual level. I don’t think—as certain right-wing commenters have argued—this is merely a matter of institutional bias. Even if there is some of that, and I have no reason to believe there is, it is implausible that the entire body of knowledge about the relatedness of phenomena is an artifact of institutional bias. Individuals make a difference, even large differences in some circumstances. But there are powerful dynamics, social and physical, that change the possibilities for individuals. And “experts” keep rubbing that in the face of people for whom those threaten their world view.

Thus the Republican mind, free to discount the experts, is able to follow its own impulse to reward individuals—especially “worthy ones”—at the expense of the collective.

It is also the case that a significant portion of the country shares the distrust of experts and is totally skeptical of “collective” solutions. Their motivations ranges from ideological convictions to racist assumptions that any governmental action benefits Blacks, immigrants and other less worthy people more than it benefits them. This group gives the Republicans enough emotional support (not to mention political support) that the GOP is not forced to examine the reality of their own positions.

And thus Republicans come up with a Tax Bill that worsens three of the four most pressing economic problems in the country–rising inequality, over reliance on deficit spending, need to invest in infrastructure and ameliorating environmental issues—and has uncertain effects on the fourth—the sluggish rate of growth.

I fear the underlying mentalities are a much greater threat than the specific awfulness of this bill. The latter can get fixed by political action. The former, which factor into a lot more than the Tax Bill, requires major changes in the way people think. I see no signs that new ways of thinking are on the horizon.

So true! As a friend of mine says in a current HuffPost piece, Paul Ryan [et al.] is stuck in his h.s. crush on Ayn Rand. [ https://www.huffingtonpost.com/entry/its-the-care-economy-stupid_us_5a4d6f52e4b0df0de8b06f59 ]

[https://img.huffingtonpost.com/asset/5a4d75401c0000270068e777.jpg?ops=1910_1000]

It’s the Care Economy, Stupid http://www.huffingtonpost.com The real “makers” and “takers” in 2018 America To great acclaim and chagrin, the Republican Congress and President have ushered in a tax bill dubbe…

What you wrote reminded me of the Repub claim — I first heard in the Reagan era, I think — that if all the money in the country was evenly redistributed tomorrow, the people who are rich and successful would in six months end up with most of the money again because they are so smart and capable and able to reach their goals!!!

C

________________________________

LikeLike

Yes…but almost 100 years ago, George Bernard agreed with the assertion that if you divided it up all evenly, it would be re-redistributed in 6 months. Which, he went on to say, is precisely why any form of government but socialism is bound to lead to inequality.

LikeLike